Rent-to-own agreements come with several advantages that could significantly benefit your financial future. However, without careful consideration, a lease option might adversely affect your finances for years to come. Understanding the pros and cons of rent-to-own is essential for making an informed real estate choice.

Pro #1: Accumulate Equity and Boost Credit Score

Rent premiums contribute directly to your down payment, typically representing 15-25% of your standard rent. Over time, this can add up to a considerable sum, unlike traditional renting where monthly payments don’t build equity. Rent-to-own is particularly beneficial for individuals looking to improve their credit score. It provides an opportunity to rebuild credit without the immediate need for a strong credit history, as rent-to-own contracts are more accessible. By maintaining lower balances, paying bills on time, and reducing debt, you can enhance your creditworthiness.

Pro #2: Lock in a Purchase Price

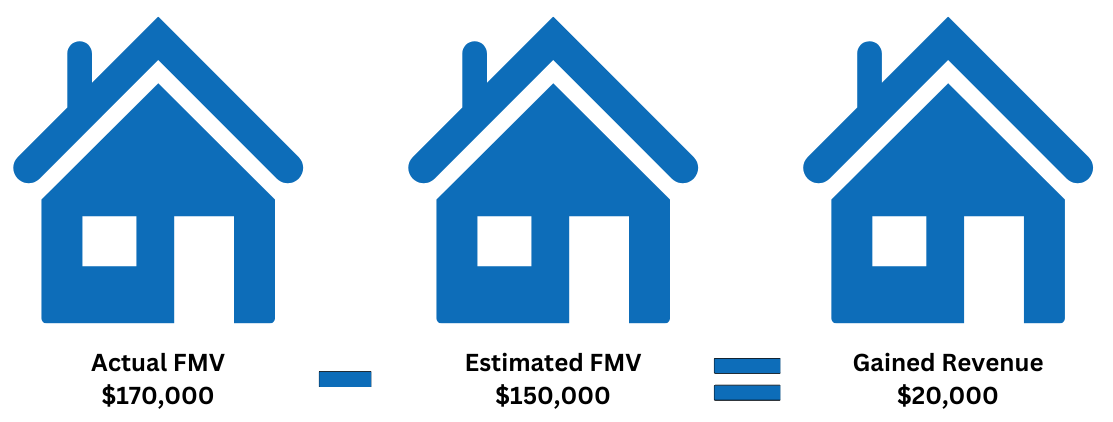

One major advantage of rent-to-own is securing the home at a fixed purchase price, shielding you from future market fluctuations. This certainty allows for better financial planning and might encourage more disciplined personal spending, possibly enabling you to buy the home sooner than expected. Additionally, if the market value of the home increases above the agreed price by the lease’s end, you stand to benefit financially. For instance:

For example, imagine Jamie and the seller estimate the home’s future fair market value (FMV) at $150,000 three years down the line. If the actual FMV at that time rises to $170,000, Jamie realizes a gain of $20,000. This scenario underscores the potential financial advantage of locking in a purchase price early in a rent-to-own agreement, especially if the property’s value increases over the lease term.

Pro #3: Get to Know the Home and Area

A key benefit of a rent-to-own arrangement is the opportunity to thoroughly acquaint yourself with the property and its surroundings before committing to purchase. This period allows you to discover the home’s advantages and areas for improvement, assess the neighborhood’s fit for your lifestyle, and identify any necessary repairs or upgrades.

Con #1: Adhere to Strict Guidelines

Rent-to-own agreements impose stringent rules, especially regarding payment deadlines. Timeliness is critical; failing to pay rent on time, even by a single day, can lead to significant repercussions. For example, a late payment might result in losing that month’s rent credit towards the home purchase, effectively reducing the equity you’ve built. Let’s explore how delayed payments can impact your equity in a rent-to-own scenario:

Jamie has a monthly rent credit of $300. Over her 36-month rent period, she incurred nine late payments. Consequently, Jamie would forfeit a total of $2,700 towards the home’s purchase cost.

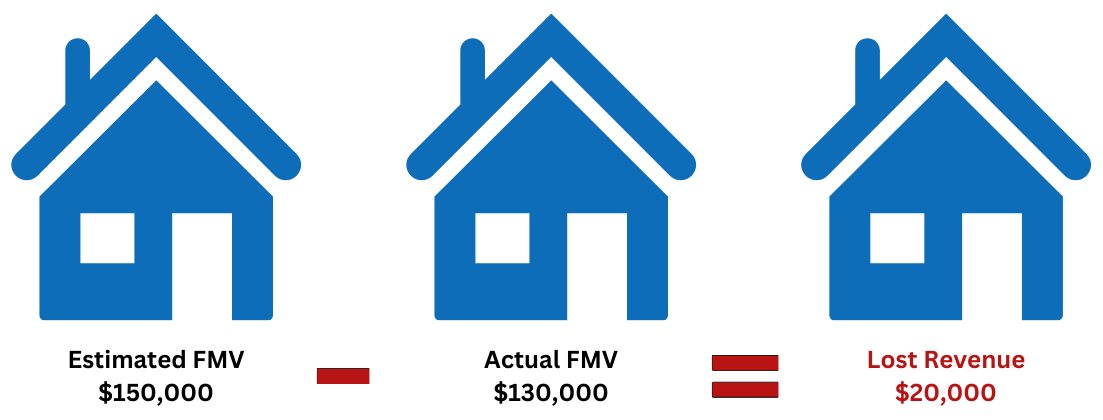

Con #2: Potential for Unpredictable Risks

Engaging in a rent-to-own agreement brings inherent uncertainties and potential risks. One risk is the possibility of overestimating the home’s future value, leading to a situation where you might pay more than its actual market worth. For instance, if Jamie and her seller predict the home’s future fair market value (FMV) to be $150,000, but it ends up being only $130,000, Jamie faces a $20,000 loss.

Furthermore, risks can also stem from the seller’s financial situation. If the seller fails to manage mortgage, tax, or other financial obligations for the property, there’s a risk of foreclosure, resulting in the potential loss of the home for you. Additionally, if you’re unable to fulfill the purchase at the contract’s end, this could lead to significant financial strain and debt accumulation on your part.