1. PURCHASE PRICE

At the start of your lease-option agreement, a purchase price for the home is set, reflecting its anticipated fair market value at lease end. To gauge the current market value, use a home value estimator available on most major banking websites. For future value predictions, seek advice from a local mortgage banker for expert insights. This agreed-upon price is fixed throughout the lease period, unaffected by future market fluctuations.

2. STANDARD RENT

Your monthly rent amount is predetermined for the lease’s duration, similar to any rental contract. It’s wise to verify that this base rent is in line with the current market rates by consulting a local mortgage banker, ensuring you’re not overpaying. Any excess payments should ideally contribute towards a rent credit. Additionally, ensure your payments cover the property’s mortgage, taxes, and insurance to avoid foreclosure risks.

3. CLOSING TIMEFRAME

The lease term length is negotiable; it should mirror the time you estimate it will take to accumulate the down payment. Clarify with the seller the payment schedule for the lease, mortgage, and any incidental expenses to maintain timely payments and avoid future disputes.

4. MAINTENANCE AND OTHER FEES

Identify who covers maintenance, utilities, and other property costs. Rent-to-own buyers usually handle all maintenance, repair, and utility expenses, unlike traditional rentals. Landlords often cover property taxes and insurance, as they still own the property. Address issues like renter’s insurance and property modifications in the contract to prevent misunderstandings.

5. OPTION FEE

The option fee secures your exclusive right to buy the home later. It’s usually non-refundable and ranges from 2% to 10% of the home’s price. If you qualify for a mortgage during the lease, you can apply the option fee and any rent credits toward the down payment. This fee is essential to keep your purchase option.

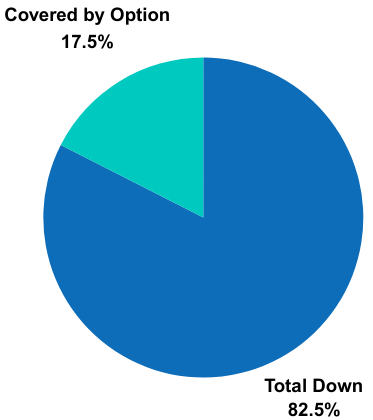

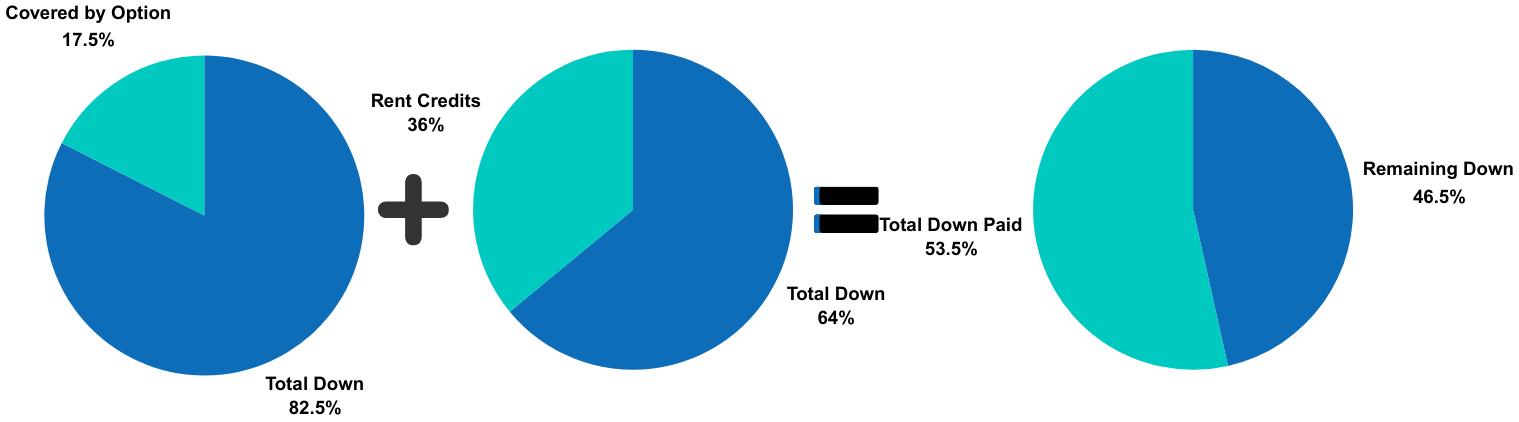

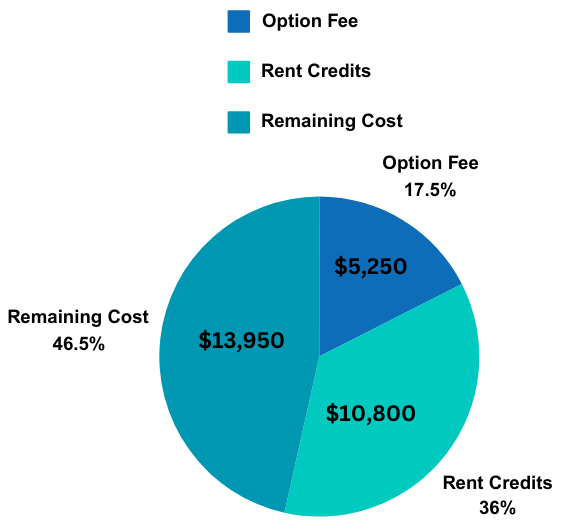

For example, Jamie wants to rent-to-own a home priced at $150,000. Typically, a 20% down payment, or $30,000, is needed for a mortgage. At the lease’s start, Jamie pays an option fee of $5,250 (3.5% of the home’s price). When buying, this $5,250 counts towards the down payment, covering 17.5% of it.

6. RENT PREMIUM

Beyond your monthly rent, you may pay a rent premium, which contributes toward the home’s future purchase, serving as a rent credit. This method helps build equity before you buy. Rent premiums, which can range from 15% to 25% of your rent, mean a higher total monthly payment but with a portion going towards home ownership.

Upon deciding to purchase, the rent premiums paid are deducted from your down payment. Note, only this premium part of your rent aids in building equity, not the total rent.

These premiums are stored in an escrow account by the seller, separate from their personal finances, and are applied to your down payment along with the option fee if you buy the home.

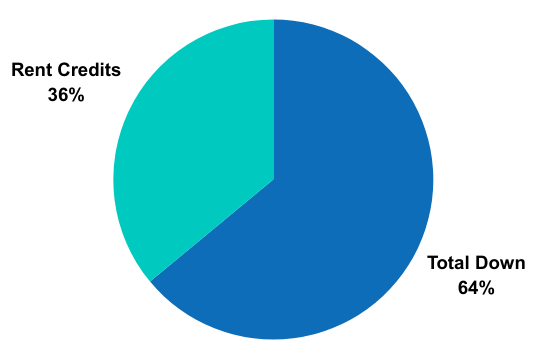

If you don’t buy, the seller keeps all the rent premiums. Continuing the previous example, if Jamie agreed to a standard rent of $1,500 and an additional $300 monthly as a rent premium, her total rent would be $1,800. Over three years, this accumulates to $10,800 in rent credits, or 36% of the down payment.

RENT CREDIT VARIATIONS

Some sellers offer to charge fair market value for rent and then credit a portion of that back if you decide to purchase the home. This arrangement can be particularly beneficial for the buyer, though it’s not very common. In such a scenario, Jamie would save the same amount of money as previously mentioned, but instead of paying $1,800 per month, she would only pay $1,500 per month. Another frequent approach is for the seller to match the buyer’s premium payments.

Continuing from the earlier example, let’s see how rent credit matching works: The seller of the home Jamie is renting-to-own agrees to match Jamie’s $300 premium payment. Therefore, instead of saving $300 per month, Jamie is saving $600 per month. Over three years, Jamie saved $21,600, or 72 percent of the down payment cost.

7. BUYING THE HOME

Now that we’ve covered how standard rent, rent credits, and option fees function, what happens when the lease concludes? Let’s calculate our total savings at the end of the lease term: Since Jamie’s option fee was $5,250 and her accumulated rent credit amounted to $10,800, by the end of her lease she has saved $16,050, which is about 53.5 percent of the down payment.

Should you find yourself unable to afford the home or choose not to proceed with the purchase at the lease’s end, the non-refundable option fee and any accumulated rent credits will be forfeited. This means you’ll lose any equity you’ve built up in the home, with the seller retaining both the option fee and the rent credits.

Viewing a lease-option agreement as a commitment to purchase is crucial. Weighing the advantages and disadvantages thoroughly is essential to safeguard against potential losses. The following section will delve into some of these critical considerations.